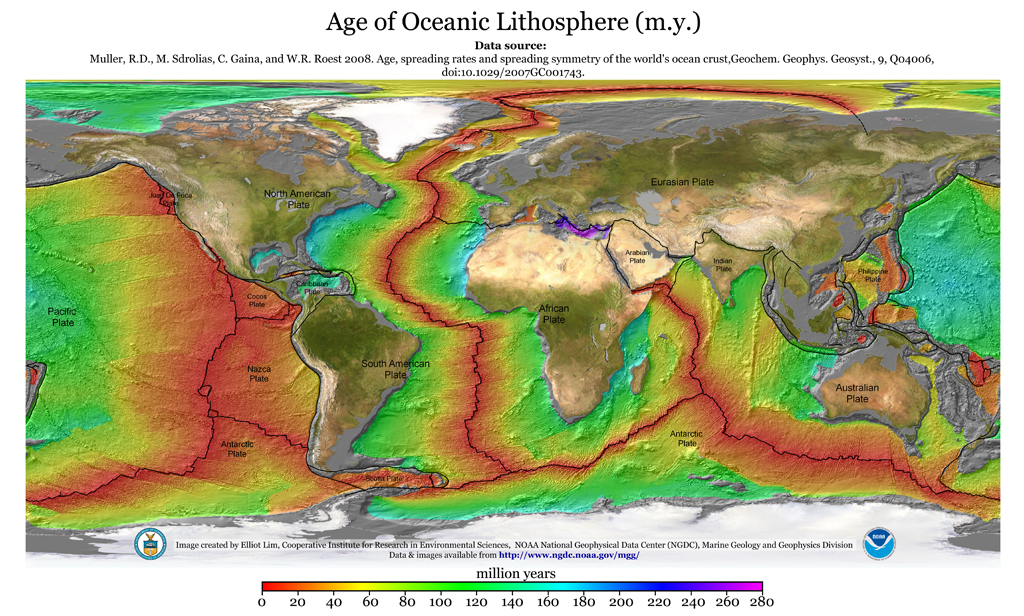

The significance of this map is that it shows subduction and plate tectonics are myths.

The oceanic lithosphere has been zircon dated by the National Geophysical Data Center. No part of the ocean floor is older than ~180-200 million years old.

If the so-called "plates" were subducting, the rifts would be the oldest part of the lithosphere, not the youngest.

There is no subduction. What you see here is called oceanic seafloor spreading.

Every rift above is a divergent spread as indicated by zircon dating.

There is drift, but it's not random, it's temporally diverging away from the rifts and causing spreads.

If there were subduction going on at continental margins wouldn't people on the beach in Oregon and California be sucked into the earth during earthquakes? So far as I know that has never happened. I'm from California; I grew up with the San Andreas fault.

The Earth is growing.

.jpg)